With investors fleeing for safe haven assets, now is the time for gold to shine. Diamonds, on the other hand, have lost their sparkle. In March, when stocks were plumbing new depths in the coronavirus crisis, the price for a single diamond carat fell by 6.8%. But the woes facing the industry actually go beyond the current crisis. Over the year, the single-carat price is down by 13.1%.

What’s going on?

Well, for starters, Covid-19 has exacerbated an existing problem. India, where 90% of the world’s rough diamonds by volume are cut and polished, is in lockdown. That has resulted in a 50% drop in diamond exports from this processing hub.

For an industry that depends on being able to dig jewels out of a mine from Canada to Angola, fly them to the trading hubs of Antwerp or Botswana, and sell them to wealthy, hopeful consumers from London to New York and Beijing, coronavirus has been a fiasco.

With shops shut and people losing their jobs in, say, the US, the world’s biggest consumer market for diamonds, but also in Europe, and China, where the market is growing, diamond prices can be expected to fall further – by 15% or more this year.

De Beers cancelled its latest sale after witnessing a 28% year-on year drop in sales, and it’s been a similar story for its rivals.

But even before the coronavirus outbreak, the market had been in a sorry state owing to a glut, coupled with declining marriage rates among millennials. London-listed Petra Diamonds, already crippled by debt, has also had scant recent success at its famous Cullinan diamond mine in South Africa.

Motivational Quote Of The Day

“Patience, persistence and perspiration make an unbeatable combination for success.”

Napoleon Hill

Alternative Quote Of The Day

“As a child my family’s menu consisted of two choices; take it or leave it.”

Buddy Hackett

That, in itself, wouldn’t be so bad for diamond merchants. Scarcity in other markets leads to higher prices. But the diamond market has had to contend with “fakes”.

In fact, artificial diamonds are not fakes – they have the same chemical and physical properties as their earth-born brethren. They are just “grown” in a lab. They are also cheaper to produce, free of any historical and ethical taint and, in theory, are potentially greener.

Colour, in the literal sense, is important for collectors, as coloured diamonds are among the most sought-after – and few more so than the pink diamonds from Rio Tinto’s Argyle mine in western Australia. Most mines will be lucky to unearth one pink in the entire haul; at Argyle, it’s about one pink carat for every 1,000 carats mined.

They are also consistently of the highest caliber, with a strong, pure, intense shade. But the mine, which gave the world around 90% of its pink diamonds, has given up all but its last 150 or so carats. It is set to close later this year.

Demand has been rising, however. So coveted are Argyle pink diamonds that it’s been rumoured Rio Tinto could end up selling the Argyle name.

Today’s National Day

NATIONAL GORGEOUS GRANDMA DAY!

PUBLISHERS NOTICE

Dear Streetwise Customer,

I’ve already written to you a couple of times about this cash generating system.

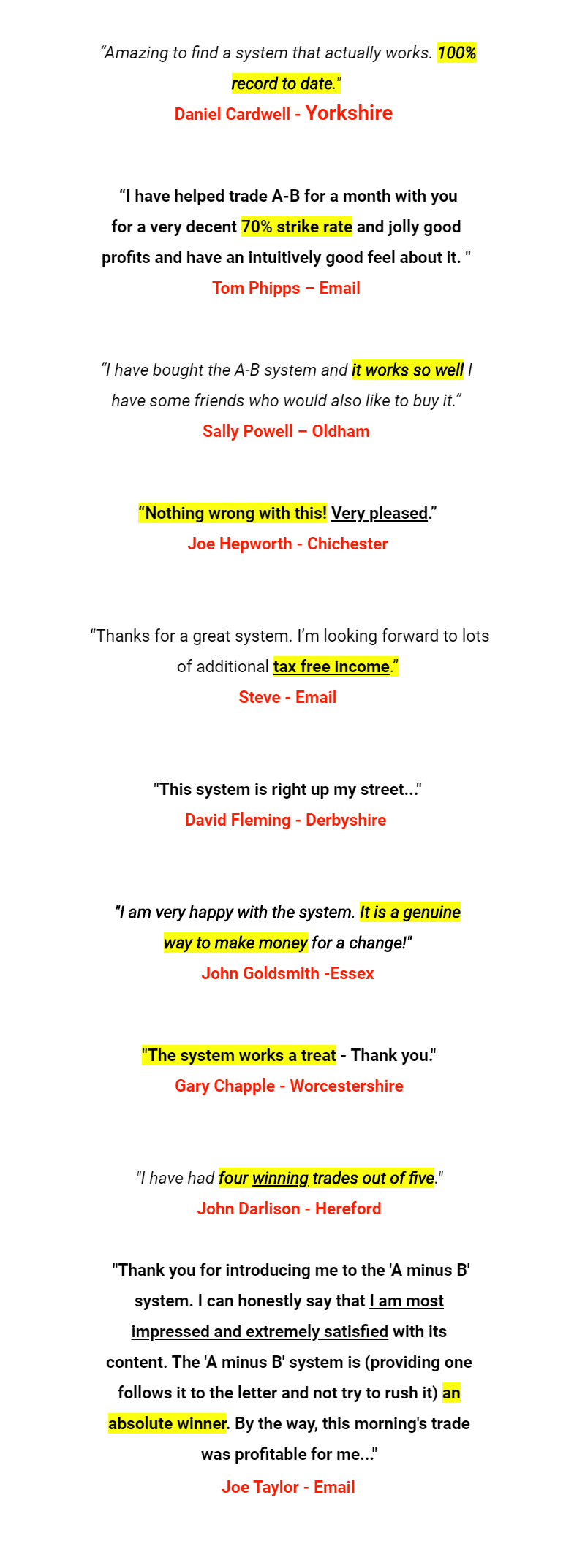

This time though, I’m not going to tell you how good this is. I’m going to let our customers do it instead!

Here are just some of the comments we’ve received recently…

(Incidentally, all of these comments are completely unsolicited and the original copies are held on file at our offices and are available for inspection.)

To get the full story take a couple of minutes to read visit the website below and read the message from David Houghton who figured this out. It reveals this extraordinary opportunity in detail.

Take A Look Now By Visiting:

www.streetwisenews.com/AB

There is absolutely No Risk to you in taking a look at this. The whole

thing comes with a full Cast Iron Money Back Guarantee. All the best for now

John Harrison

Streetwise Publications

PS. Just for good measure here are Mike Pears comments on the A Minus B System:

“O.k. – here are my updates on the A-B System up to my trading week 51. These are all to level stakes.

Week 40 – w/c 16/2 – loss of 16 pts

Week 41 – w/c 23/2 – profit of 37 pts

Week 42 – w/c 2/3 – loss of 2 pts

Week 43 – w/c 9/3 – profit of 80 pts

Week 44 – w/c 16/3 – profit of 37 pts

Week 45 – w/c 23/3 – profit of 75 pts

Week 46 – w/c 30/3 – profit of 38 pts

Week 47 – w/c 6/4 – loss of 51 pts

Week 48 – w/c 13/4 – profit of 62 pts

Week 49 – w/c 20/4 – profit of 30 pts

Week 50 – w/c 27/4 – profit of 144 pts

Week 51 – w/c 4/5 – loss of 45 pts

Total Level stakes profit is 1,821 pts which averages 36.42 per week… A £1,000 starting bankusing 0.1% stakes, now stands at £5,569.”